WORK WITH ME

You don’t have to navigate this alone. Whether you're starting from scratch, healing from financial trauma, or leveling up your money game—I offer services designed to meet you where you are and help you move forward with clarity and confidence.

1-ON-1 COACHING

If you’re looking to receive personalized guidance tailored specifically to your financial needs, I offer 1-on-1 coaching to help you achieve your financial goals. Through a trauma-informed lens, these sessions are all about you! We will work together to create a customized financial plan with clear, actionable steps to move you closer to financial independence.

-1.png?width=359&height=480&name=Brown%20Beige%20Aesthetic%20Trendy%20Daily%20Reminder%20Photo%20Frame%20Your%20Story%20(7)-1.png)

GROUP COACHING

Looking for like-minded individuals on the same path towards financial healing and independence? My group coaching sessions offer a collaborative and supportive environment where we tackle a variety of financial topics together. These sessions take place over several weeks with the same group, allowing you to learn from each other’s experiences and to make lasting connections.

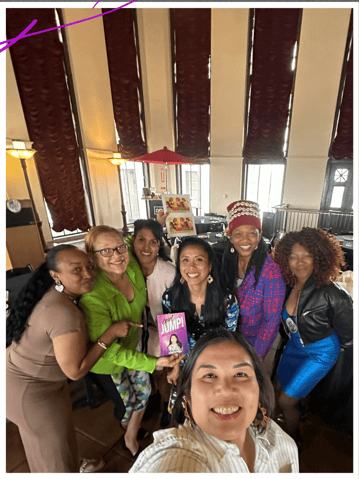

SPEAKING EVENTS

Looking for a speaker who can make money feel less scary and more empowering? I offer personalized presentations on topics like budgeting, financial abuse, money mindset, and building financial autonomy—designed to meet your audience where they are and leave them feeling equipped and inspired.

-1.png?width=359&height=485&name=Brown%20Beige%20Aesthetic%20Trendy%20Daily%20Reminder%20Photo%20Frame%20Your%20Story%20(6)-1.png)